Closely Held Business Stock

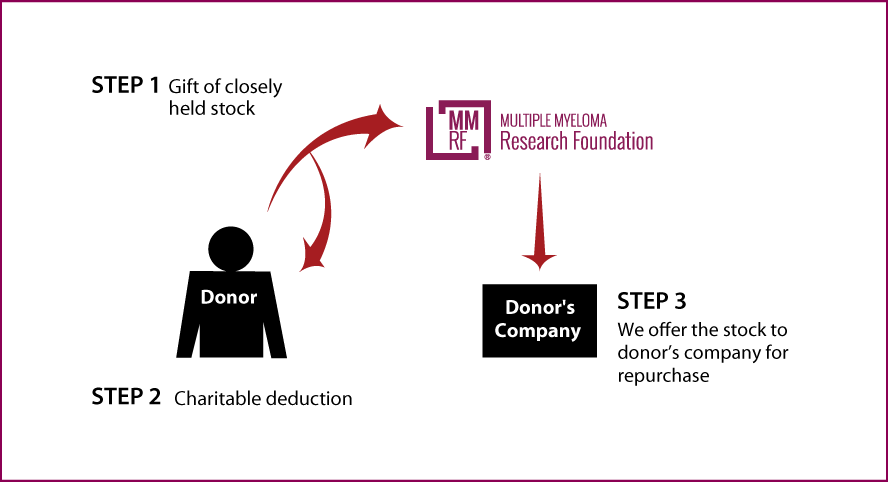

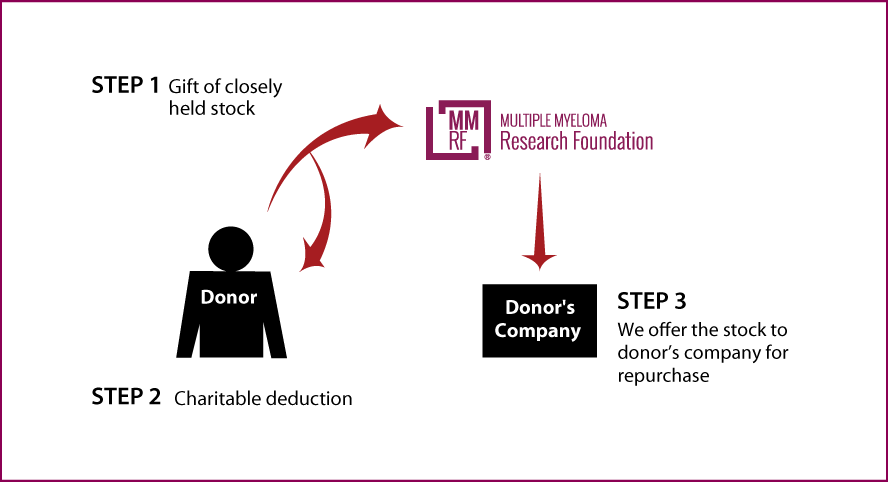

How It Works

- You make a gift of your closely held stock to the MMRF and get a qualified appraisal to determine its value

- You receive a charitable income-tax deduction for the full fair-market value of the stock

- The MMRF may keep the stock or offer to sell it back to your company

Benefits

- You receive an income-tax deduction for the fair-market value of stock

- You pay no capital-gain tax on any appreciation

- Your company may repurchase the stock, thereby keeping your ownership interest intact

- The MMRF receives a significant gift

More Information

Which Gift Is Right for You?

Back

© Pentera, Inc. Planned giving content. All rights reserved.

Disclaimer